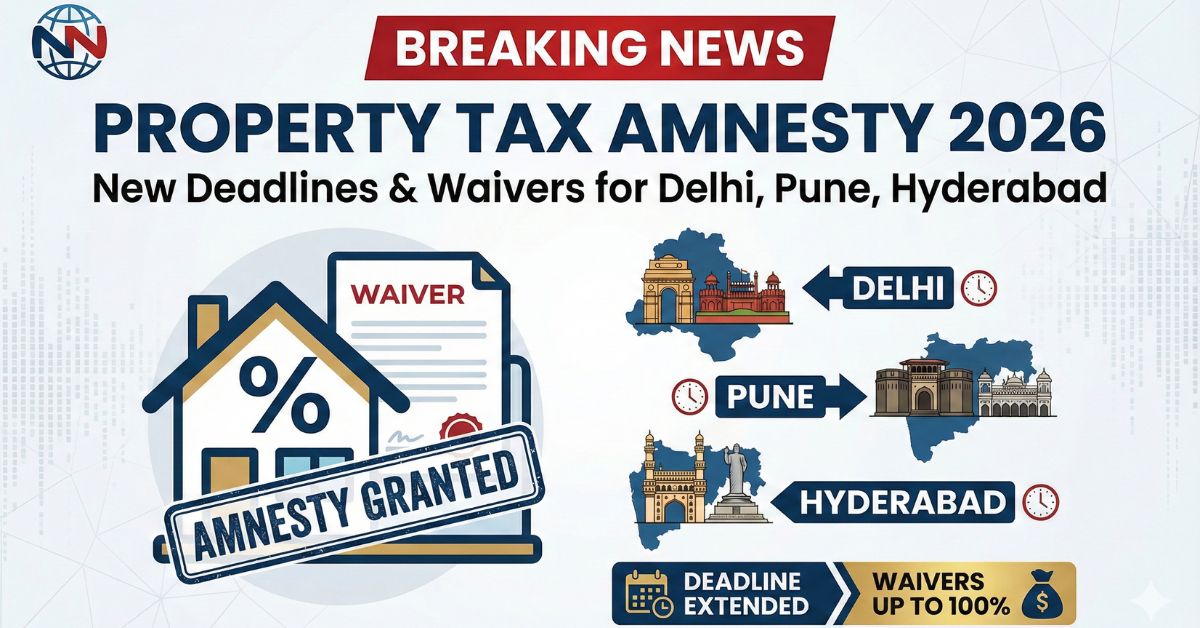

If you are a property owner in India and have pending tax dues, this is the most critical update for you this month. Several municipal corporations across major Indian cities—including Delhi, Pune, and Hyderabad—have announced or extended their Property Tax Amnesty Schemes for early 2026.

These schemes offer massive relief, including waivers on interest and penalties, but the deadlines are fast approaching. Here is everything you need to know to save money and clear your legal dues.

1. Delhi: MCD Extends ‘SUNIYO’ Scheme Deadline

The Municipal Corporation of Delhi (MCD) has brought relief to thousands of property owners by extending its popular SUNIYO (Sumpattikar Niptaan Yojana) 2025-26 scheme.

- New Deadline: The scheme is now valid until January 31, 2026.

- The Benefit: If you pay the principal tax amount for the current year (2025-26) and the previous 5 years (2020-21 to 2024-25), you get a 100% waiver on interest and penalties.

- Old Dues Waived: Even better, all property tax dues (principal, interest, and penalty) from before April 1, 2020, will be completely waived off.

- Important Condition: Since this is an extension, a modest 5% late fee is now applicable on the payment, but this is still far cheaper than paying the full accumulated interest.

Why it matters: This is a “golden opportunity” for Delhi residents to regularize their property status. Reports show that over 1.6 lakh taxpayers have already used this scheme to clear dues worth over ₹800 crore.

2. Pune: PMC Amnesty Scheme Extended till mid-February

For residents of Pune, the Pune Municipal Corporation (PMC) has also announced an extension to its amnesty scheme due to high public demand.

- New Deadline: Extended to February 16, 2026.

- The Benefit: The scheme offers a 75% waiver on the penalty amount for those who clear their outstanding dues in full.

- Impact: The PMC has already collected over ₹713 crore through this initiative. The 2% monthly penalty on delayed tax usually adds up to a huge burden, so a 75% cut is a significant saving.

3. Hyderabad: GHMC Launches One-Time Settlement (OTS)

The Greater Hyderabad Municipal Corporation (GHMC) has launched a fresh One-Time Settlement (OTS) scheme for the year 2025-26 to help defaulters.

- The Offer: Property owners can get a 90% waiver on accumulated interest on tax arrears.

- Payment Rule: To avail of this, you must pay the total principal tax amount along with just 10% of the interest in a single payment.

- Applicability: This offer applies to arrears from previous years, not the current year’s tax.

Digital Shift: Chhattisgarh Sets a New Record

In related news, Dhamtari district in Chhattisgarh has become the first district in India to collect property tax digitally through the ‘SAMARTH Panchayat’ portal as of January 29, 2026. This marks a major step in bringing digital ease to rural property owners, allowing them to pay taxes via UPI from home.

Why You Should Pay Now

Ignoring property tax can lead to serious legal trouble. Municipal bodies in India are becoming stricter with enforcement.

- Avoid Legal Action: Councils can seal properties or attach bank accounts of long-term defaulters.

- Property Valuation: Clear tax records are mandatory if you plan to sell or mortgage your property.

- Better Civic Facilities: Your tax money funds local roads, drainage, and waste management.

How to Pay Property Tax Online (General Steps)

Most Indian cities now have online portals. Here is a simple guide:

- Visit your municipal corporation’s official website (e.g., MCD Online, GHMC, or PMC website).

- Look for the “Pay Property Tax” or “Citizen Services” tab.

- Enter your Property ID, UPIC, or Registered Mobile Number.

- Check your outstanding dues and select the “Amnesty / OTS Scheme” option if available.

- Pay using Net Banking, UPI, or Credit/Debit Card.

- Download the Receipt immediately for your records.

Frequently Asked Questions (FAQs)

Q1: What happens if I miss the amnesty deadline?

If you miss the deadline, you will likely have to pay the full tax amount plus high interest (often 12% to 24% per year) and heavy penalties. You may also face legal notices.

Q2: Can I pay property tax for just one year under the amnesty scheme?

Usually, no. To get the waiver benefits (like interest removal), most schemes require you to clear all outstanding principal dues for the specified period.

Q3: Is the 5% late fee in Delhi mandatory?

Yes. Since the original deadline has passed, the MCD has added a 5% late fee for the extended period ending January 31, 2026. This fee is non-negotiable.

Q4: Can I pay offline?

Yes, most corporations allow payments at designated “Mee Seva” centers, citizen service bureaus, or authorized bank branches. However, online payment is faster and avoids queues.

Q5: Is property tax applicable to vacant land?

Yes, most municipal bodies levy tax on vacant land, though the rates might differ from constructed properties.